Results 931 to 940 of 972

-

Verified Tsikot Member

Verified Tsikot Member

- Join Date

- Aug 2015

- Posts

- 862

February 16th, 2017 05:28 PM #931thanks bro for the advice, I was looking to sell some of my positions para mas maliit ung portfolio ko but to my surprise sila pa yung strong ngayon. Now debating if I should take small profits or soldier on with those. mabuti nalang meron din ako index funds + Exchange traded fund that tracks the index na rin. Its true what you said, talagang maganda ang outlook for the economy so hopefully makikiride lang ang pera naten sa PSEi. I also have bond funds, but that's another story.

-

-

Verified Tsikot Member

Verified Tsikot Member

- Join Date

- Nov 2005

- Posts

- 1,078

May 5th, 2017 03:12 PM #933Sabi ng mga dutertards dahil sa poon nila yan. Fentanyl pa more.

PSEi could zoom past 9,��� on Duterte’s economic tack | Inquirer Business

PSEi could zoom past 9,000 on Duterte’s economic tack

Take note last year pa yan article na yan.THE LOCAL stock barometer could breach the 9,000 mark next year on upbeat corporate earnings prospects backed by “transformational” reforms laid out by the Duterte administration to rebalance the Metro Manila-centric economy, the head of BPI Securities said.

-

Tsikoteer

Tsikoteer

- Join Date

- Jul 2013

- Posts

- 2,450

-

May 6th, 2017 01:58 PM #935

it's easy to spin the news in both directions

when you're anti-du30, you can always blame him when stocks fall

when you're pro-du30, you can always credit him when stocks rise

bullsh*t and bullsh*t

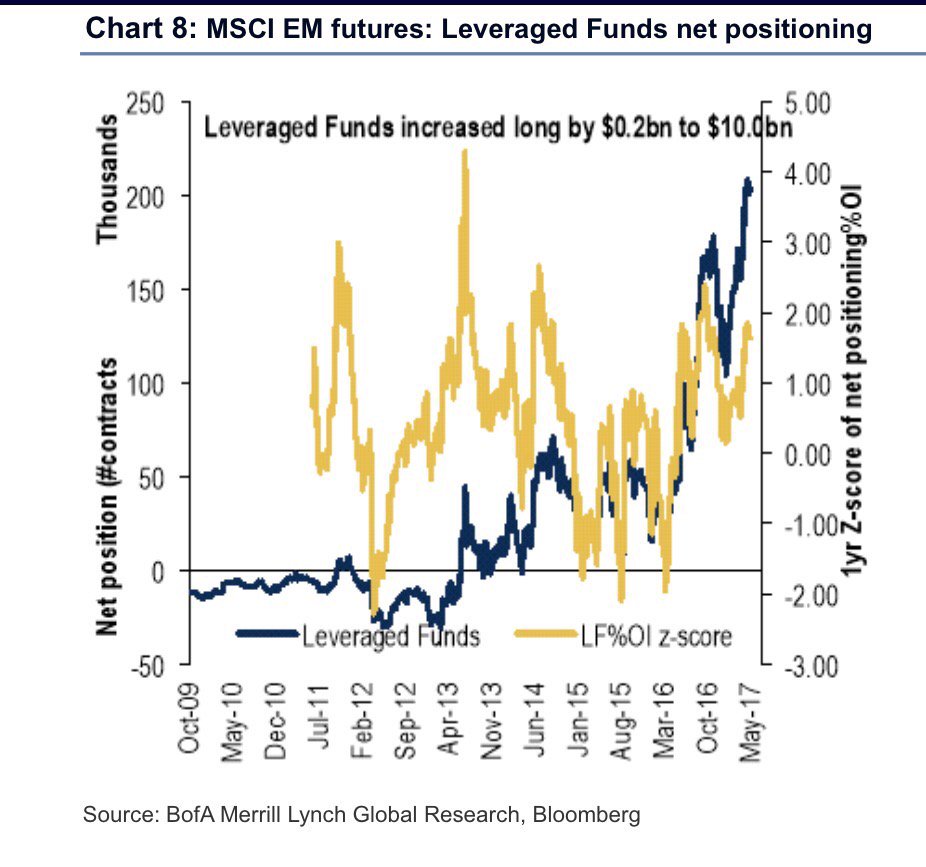

THIS IS WHY PSEI IS UP

inflow of foreign funds

explain ko kung ano yan

those are bets on MSCI's emerging market index futures (in case may hindi nakakaalam, ang Pinas po ay emerging market)

above zero are long positions (betting the index is going up)

below zero are short positions (betting the index is going down)

as you can see a lot of money flowed into emerging market futures

funds are net long

damay ang Pinas dyanLast edited by uls; May 6th, 2017 at 03:09 PM.

-

May 6th, 2017 04:07 PM #936

IMHO, you have too many stocks/companies to monitor plus gain presumably is limited unless you are investing at least 100k each else posible maliit din ang total returns mo kahit panalo ang stocks pick mo. On the flipside, baka better pa if you subscribe to equity fund of uitf, mf, or vl. Goodluck.

Sent from my SM-G610Y using Tapatalk

-

Tsikoteer

Tsikoteer

- Join Date

- Aug 2003

- Posts

- 9,720

May 6th, 2017 04:22 PM #937Regarding taxes : while they plan to lower the income taxes for the least compensated in PH society, do note that they are planning to tax diesel and sugar -- up to 2-3 pesos/liter and 5 pesos/kilo respectively. Good for the pockets of the trapos este the government, bad for spending power. On the other hand some people are saying our stock market is rising because of the tax plan....pick your (pied) piper i suppose 😀

-

May 6th, 2017 04:37 PM #938

Sabi nga nila, madaming lumalabas na expert pag bullish ang stock market.😎

Sent from my SM-G610Y using Tapatalk

-

May 6th, 2017 04:55 PM #939

on increasing taxes whether it's good or bad for the economy

negative spin: taking away consumers' disposable income is bad for the economy

positive spin: increased gov't spending is good for the economy

so depende kung pro or anti du30 ka

meron ka argument

-

May 6th, 2017 05:07 PM #940

Reply With Quote

Reply With Quote

Sec. Dizon and RSA seem to have a really good working relationship, btw.

EDSA Rehab/Rebuild and Guadalupe Bridge Repair