Results 11 to 20 of 24

-

April 3rd, 2011 07:29 PM #11

the price of oil is based on what is being pumped out of the ground. not based on the trillions of barrels still under the ground

it doesnt matter to the market how much undiscovered oil there is under the ground

from the time of discovery of a new oil field to the time the new oil field comes online takes years. so it doesnt freaking matter

current global oil production is around 88 million barrels per pay

current global oil consumption is 86+ million barrels per day

that's less than 2 million barrels of spare capacity

easy to understand why the market is so jumpy

a disruption in any major oil producer can wipe out that spare capacity

when supply > demand, you're safe

when supply = demand, you're on the edge

when supply < demand, you're screwed

that's why the price of oil is where it is now

everyone's betting on more supply disruptions

and stronger demandLast edited by uls; April 3rd, 2011 at 07:31 PM.

-

BANNED BANNED BANNED

BANNED BANNED BANNED

- Join Date

- Nov 2008

- Posts

- 1,383

April 3rd, 2011 07:35 PM #12

-

-

BANNED BANNED BANNED

BANNED BANNED BANNED

- Join Date

- Sep 2010

- Posts

- 420

April 4th, 2011 02:01 AM #14

-

BANNED BANNED BANNED

BANNED BANNED BANNED

- Join Date

- Sep 2010

- Posts

- 420

April 4th, 2011 02:13 AM #15

kaw naman *uls, debt is a convenient scapegoat bec. it is intangible.

when money was backed by gold, then it won't be long that Gold will be depleted bec. it can be stolen.

the same is true if people learn the nature that the monetary system is backed by oil.

so the Fed never contests that the entire monetary system is backed by debt bec. how can anybody steal or hoard debt.

debt is only payable if people work. if people work all the time, then how come people are still in debt. the harder they work, the greater the govt. plunge in debt.

so i never really bought that idea that debt backs the monetary system.

work / productivity in our lifetime is only possible if there is energy, and therefore, the entire system depends entirely on oil.

-

BANNED BANNED BANNED

BANNED BANNED BANNED

- Join Date

- Sep 2010

- Posts

- 420

April 4th, 2011 02:16 AM #16

-

April 4th, 2011 11:20 AM #17

-

April 4th, 2011 11:30 AM #18

let's go back a bit

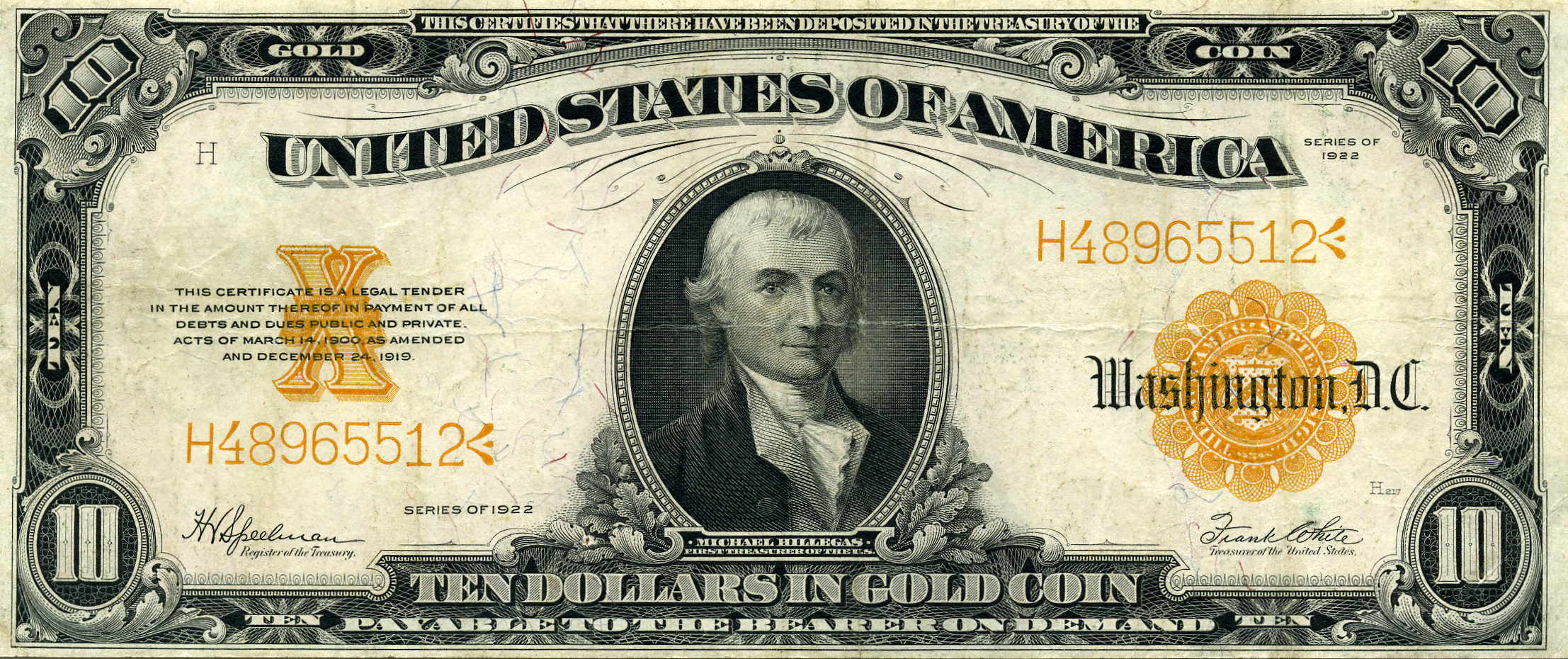

what is gold-backed money?

a bank has gold in its vault and it issues certificates that say the certificates represent X amount of gold. the certificates can be used to buy things with

and the certificates can also be used redeem gold from the bank

oil-backed money? which bank has oil in its vault? show me the bank coz i have USD and i want redeem my oil

-

April 4th, 2011 11:43 AM #19

you don't even know what insider info is

"studying the trends and graphs for forecasting / trending" is insider info?

how can that be insider info when everyone has access to graphs?

insider info is like this --- let's say i'm an executive of a company. the company is planning to buy a competitor. nobody outside the company knows about the plan. what i do i tell some friends to buy the shares of the target company. days later, the plan is announced to the public and the share price of the target company rises -- that's INSIDER info. kaya tinawag na insider

--

oil futures are used to bet on the FUTURE price of oil

so even if there really isnt oil shortage at present, speculators are betting there will be shortage in the future. kaya tumataas ang oil price

the market always thinks in advance

-

April 4th, 2011 11:55 AM #20

sorry OT na. si OB ang nag bring up nito eh

here's gold-backed paper money:

when paper money was backed by gold, you can go to the bank and exchange it for real gold

show me oil-backed paper money

i wanna go the a bank and redeem my oil

--

OB:

coz it is in the best interest of the bankers to keep people and governments in debtdebt is only payable if people work. if people work all the time, then how come people are still in debt. the harder they work, the greater the govt. plunge in debt.

ever growing debt is required to keep the global monetary system going. if all debt is paid, the system will collapseLast edited by uls; April 4th, 2011 at 12:53 PM.

Reply With Quote

Reply With Quote

Be careful with channels like "China Observer" on YouTube. There is a clear bias in their posts and...

Xiaomi E-Car