Results 41 to 50 of 272

-

June 8th, 2013 07:15 PM #41yes syempre stock mutual funds can lose money. anyone investing in stock mutual funds thinking high returns are guaranteed is delusionalTake a look at the fund performances; hindi porke "professionally managed" e immune ka na sa losses. Basically you have a group of people betting on a couple of stocks; if they bet right, then good, you should get at least at par with the index performance. If they bet big(e.g. stock they bought went down), your fund can actually lose money.

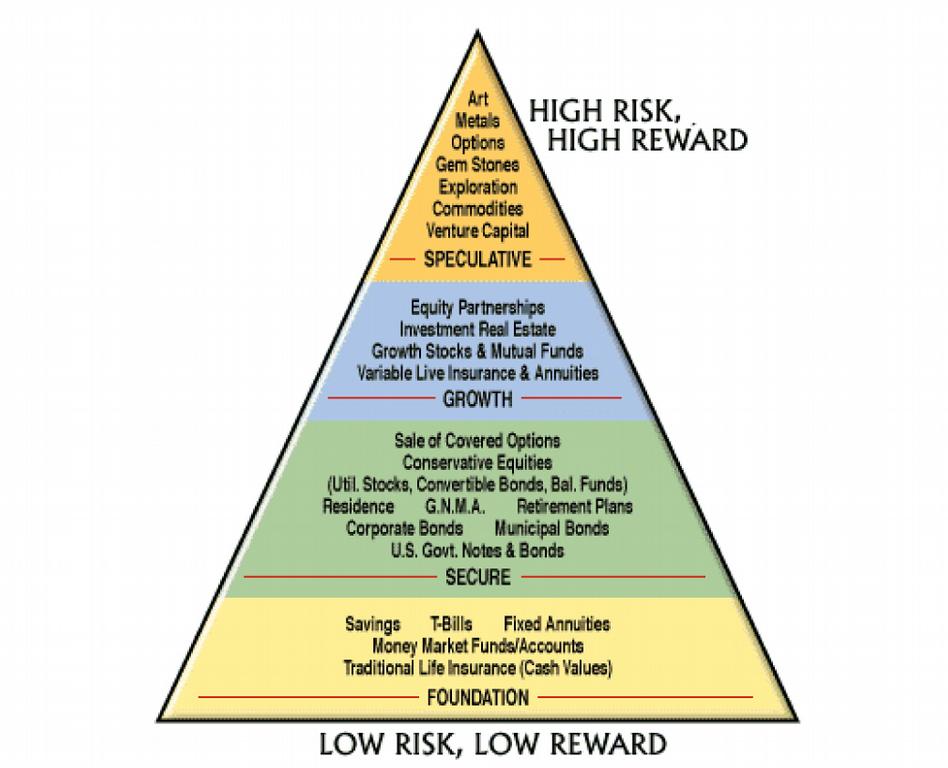

when you're putting money in stock mutual funds you're going up the risk pyramid

-

Tsikoteer

Tsikoteer

- Join Date

- Aug 2003

- Posts

- 9,720

June 8th, 2013 09:03 PM #42In a perfect world we'd all invest in super safe investments....pero imho, you have to have a lot of cash invested in them, such that you can live off the pathetic interests. Kasi kung maliit lang iinvest mo, parang wala din. Imho no choice eh, kakainin ka ng buhay ng inflation

Imho, while you're still young, save money, invest, take some risks(smart, calculated risks mind you) while you can recover fast and have family to back you up. Then, God wiling if you have your cash hoard, saksak mo lahat sa safe investments.Last edited by badkuk; June 8th, 2013 at 09:05 PM.

-

June 9th, 2013 11:57 AM #43

you shouldnt have all your money in safe assets no matter how much money you have

unless there's an ongoing financial crisis where banks are failing everywhere then cash is king --- that's capital preservation (during the 2008 US financial crisis return on capital no longer mattered. the priority was return of capital. i heard stories of people withdrawing huge amounts of cash and putting them in safe deposit boxes)

in normal times you want capital appreciation instead of capital preservation so you venture out into riskier assets so you hold as little cash as possible

-

June 9th, 2013 12:16 PM #44

typical "normal times" portfoltio:

50% in stocks

25% in bonds

the rest in cash and cash equivalentsLast edited by uls; June 9th, 2013 at 12:22 PM.

-

June 9th, 2013 12:57 PM #45

Sirs, ano ba magiging trend ng stock market in the months to come? downfall pa rin ba? or uptrend na?

-

June 9th, 2013 01:24 PM #46

-

-

June 10th, 2013 10:37 AM #48

-

-

Reply With Quote

Reply With Quote

Be careful with channels like "China Observer" on YouTube. There is a clear bias in their posts and...

Xiaomi E-Car